GLOBAL stocks rallied ahead of the release of the US inflation report for August in expectation that it would indicate inflation was at a peak.

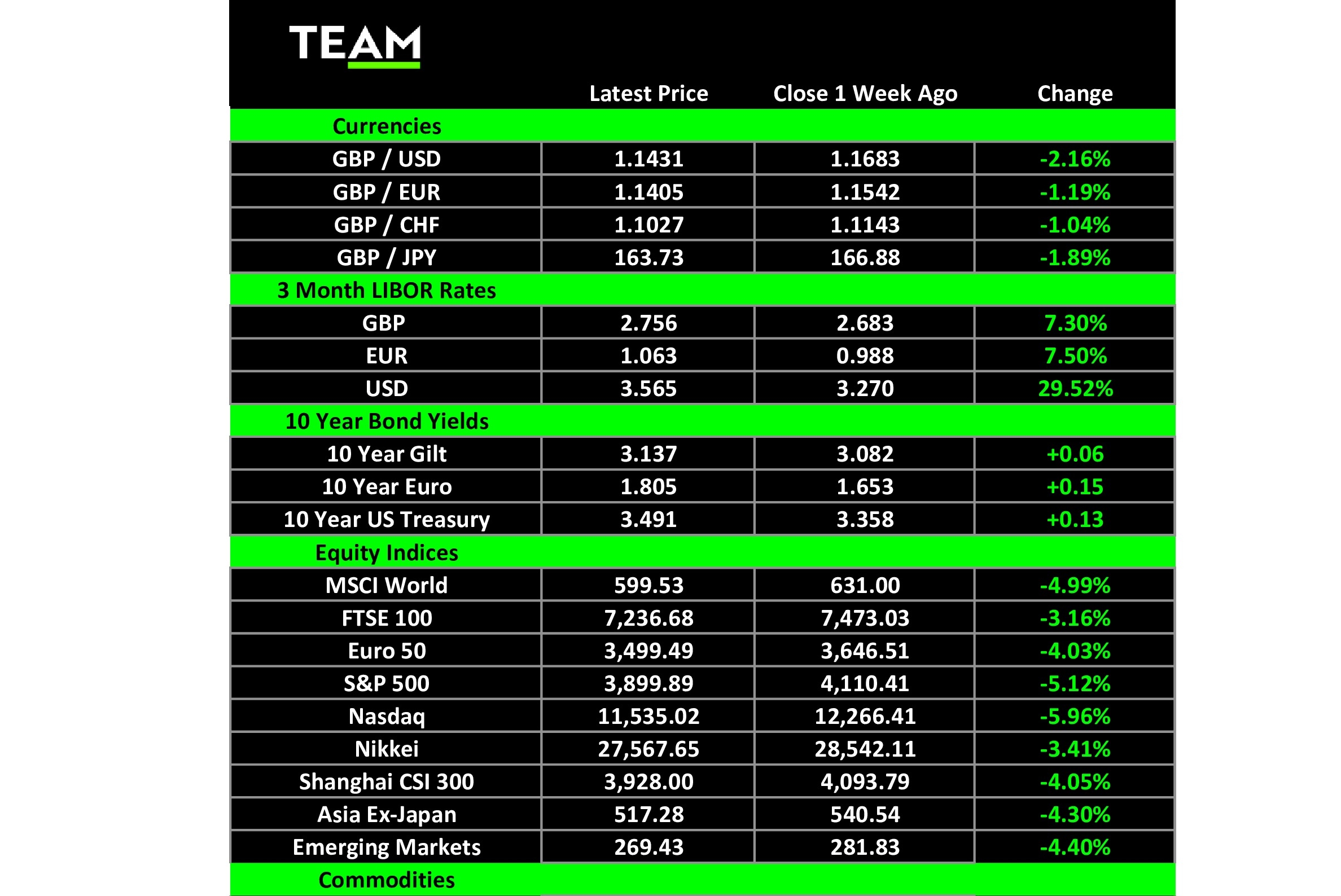

However, it proved to be a false dawn and stocks went into reverse, suffering their worst one-day fall since June 2020. Over the week, the blue-chip S&P 500 and technology-focused Nasdaq indices fell 5.1% and 6.0% respectively.

While headline annual CPI inflation slowed to 8.3%, from 8.5% a month earlier on the back of lower gasoline prices, a range of underlying inflation measures continued to accelerate, suggesting it is becoming more broad-based. The ‘core’ measure, which strips out food and energy, the most volatile components of inflation, increased from 5.9% to 6.3%.

The sharp reversal in stocks reflects concerns that the Federal Reserve will need to act even more aggressively to prevent inflation becoming more entrenched across a wide range of goods and services, and markets are now pricing in a 0.75% interest-rate hike at this week’s Federal Open Market Committee meeting. The higher interest rates go, the greater the risk of a recession.

The UK’s inflation report for August was released a day later and painted a similar picture. Headline annual CPI inflation slowed to 9.9%, still the highest rate in the G7, but the core measure edged up to 6.3%. The Bank of England is also expected to raise interest rates by 0.75% this week.

The inflationary environment has forced many consumers to adapt and change their shopping habits, especially for non-discretionary items such as groceries.

A decade ago, the incumbent big four supermarkets – Tesco, Sainsbury’s, Asda and Morrisons – accounted for more than three-quarters of the market, but, since then, discounters, led by Aldi and Lidl, have chipped away at their market share.

The higher cost of living has accelerated their progress as consumers prioritise value and, according to the latest figures released by Kantar last week, Aldi has overtaken Morrisons to become the UK’s fourth-largest supermarket group.

Markets were hit by another jolt on Friday when FedEx Corp issued a profit warning and announced plans to close offices and freeze job hiring as it expects revenue will fall $500 million short of its target this year. Shares in the package-delivery giant, regarded as a bellwether of the global economy, dived more than 20%, its biggest one-day fall since it listed on the New York Stock Exchange in 1978.

Despite the more challenging economic outlook, Volkswagen is on track to float 12.5% of Porsche next week on the Frankfurt Stock Exchange in what will be Europe’s third-biggest-ever IPO. At the weekend, VW revealed it was targeting a valuation of 70-75 billion euros for the iconic sports car brand and proceeds raised would be used to pay a one-off special dividend and to invest in electric-vehicle and battery technology.

The Porsche-Piech families will also acquire an additional 12.5% stake in Porsche at a 7.5% premium to the IPO price. Unlike those on offer to the public, their shares will carry voting rights.

The prospect of slowing economies continued to weigh on energy prices and brent crude slid to $92 a barrel. In its latest forecast, the International Energy Agency predicted that China’s zero-Covid policies would result in the market being oversupplied for the remainder of the year but supply and demand should be more balanced in early 2023 once Europe’s ban on Russian seaborne crude imports takes effect.