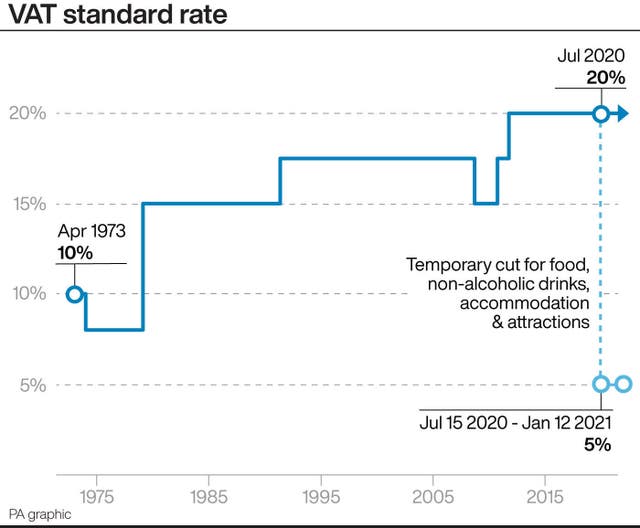

VAT is to be slashed on food, accommodation and attractions in a major boost for hospitality firms hit hard by the coronavirus pandemic.

Chancellor Rishi Sunak announced that tourism and hospitality VAT will be cut from 20% to 5% for the next six months in his “mini-budget” announcement.

The move will cut the tax on eat-in and hot takeaway food from restaurants, cafes and pubs, which have started to reopen over the past week.

We’re reducing VAT to 5% for goods and services supplied by the tourism and hospitality sectors.

This is a £4bn catalyst benefiting over 150,000 businesses, and consumers everywhere – all helping to protect 2.4 million jobs. #PlanForJobs pic.twitter.com/B9LKptz4Qy

— Rishi Sunak (@RishiSunak) July 8, 2020

Mr Sunak also said the move will benefit accommodation in hotels, B&Bs, campsites and caravan sites, while attractions such as cinemas, theme parks and zoos will also see the tax cut.

It will be reduced from Wednesday July 15 until January 12, he told MPs.

The temporary VAT cut does not include alcoholic drinks, the Treasury’s “plan for jobs” document said.

Mr Sunak added: “This is a £4 billion catalyst for the hospitality and tourism sectors, benefiting over 150,000 businesses, and consumers everywhere – all helping to protect 2.4 million jobs.”

The Chancellor also announced plans to give people a 50% discount, up to £10 per head, to eat out in restaurants in August.

To support restaurants and the people who work in them we’re saying ‘Eat Out to Help Out’.

So for the month of August we will give you a 50% reduction, up to £10 per head, on sit-down meals and non-alcoholic drinks Monday-Wednesday. #PlanForJobs pic.twitter.com/D6eznIDjqC

— Rishi Sunak (@RishiSunak) July 8, 2020

Russell Nathan, senior partner at accountancy firm HW Fisher, said: “Our restaurants, pubs, shops and hotels are struggling.

“This is a timely announcement from Government as businesses are in desperate need of a clear action plan.

“It is vital we see the hospitality industry back up and running, and these measures announced today will provide an essential lifeline for many UK businesses.”

David Weston, chairman of the Bed & Breakfast Association, said: “We are delighted by the VAT cut on behalf of our larger members, guesthouses and small hotels who are VAT registered.

“It will help stimulate demand and, once our borders open to incoming tourism, will also help UK tourism overall as Britain’s VAT rate has been amongst the highest of our international competitors.”

But he warned that many firms involved in inbound tourism are “on the brink” and will not benefit from those measures.

“Longer-term support will still be required for these businesses,” he added.

The Chancellor also announced plans to support businesses bringing staff out of furlough through a new Jobs Retention Bonus Scheme.

Mr Sunak said the Government could pay up to £9 billion to businesses, as part of the programme which will see firms paid £1,000 per employee brought out of furlough, in a move which will particularly benefit the hospitality sector.